Bitcoin, Explained for Beginners

A shady form of payment, a speculative bubble or the future of finance? Here’s how to make sense of the news around Bitcoin.

The value of Bitcoin broke all records in March 2021.

The spot price to buy a bitcoin — the world’s first and most popular digital currency — briefly rose above $60,000 on March 13, 2021. (For context, the cryptocurrency's all-time low is from 2013, when it was priced at $67.81.) With such a meteoric rise, many are wondering: What, exactly, is Bitcoin, and where does it get its value? Years from now, will we talk about the Bitcoin boom and bust periods as we do about the Gold Rush? Or, will it become a staple in a diversified investment portfolio and a common way to buy a pizza?

For the most part, the jury’s still out. But the past 10 years have given us a better indication of the role Bitcoin might play in the portfolios of retail investors and large institutions alike.

Definition: What is Bitcoin?

Bitcoin was launched in 2009 and is regarded as the first cryptocurrency. It’s a decentralized form of digital cash that eliminates the need for traditional intermediaries like banks and governments to make financial transactions. Still feeling a little confused? Don’t worry, that’s normal.

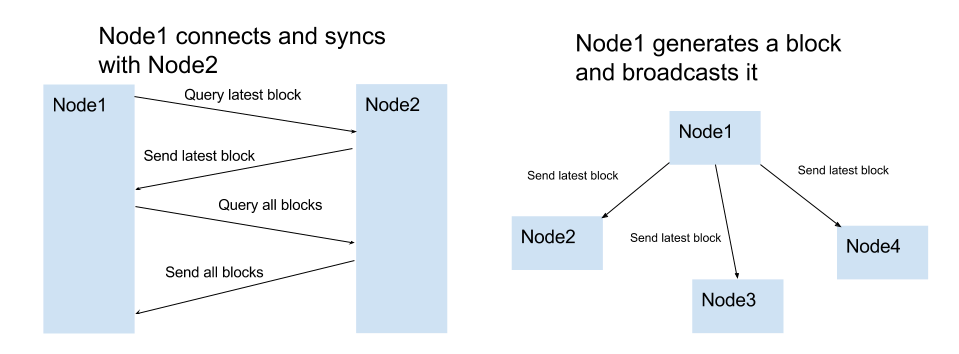

Fiat money (like the U.S. dollars in your bank account) is backed and regulated by the government that issues it. Bitcoin, on the other hand, is powered through a combination of peer-to-peer technology — a network of individuals, much like the volunteer editors who create Wikipedia — and software-driven cryptography, the science of passing secret information that can only be read by the sender and receiver. This creates a currency backed by code rather than items of physical value, like gold or silver, or by trust in central authorities like the U.S. dollar or Japanese yen.

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party,” wrote Satoshi Nakamoto — the pseudonym of the mysterious Bitcoin creator, who remains unknown — in a white paper introducing the open-source technology. It’s come a long way since then, now accepted as payment by AT&T, the Dallas Mavericks and Wikipedia, among others.

How does Bitcoin work?

Each bitcoin (trading symbol “BTC,” though “XBT” is also used) is a computer file stored in a digital wallet on a computer or smartphone. To understand how the cryptocurrency works, it helps to understand these terms and a little context:

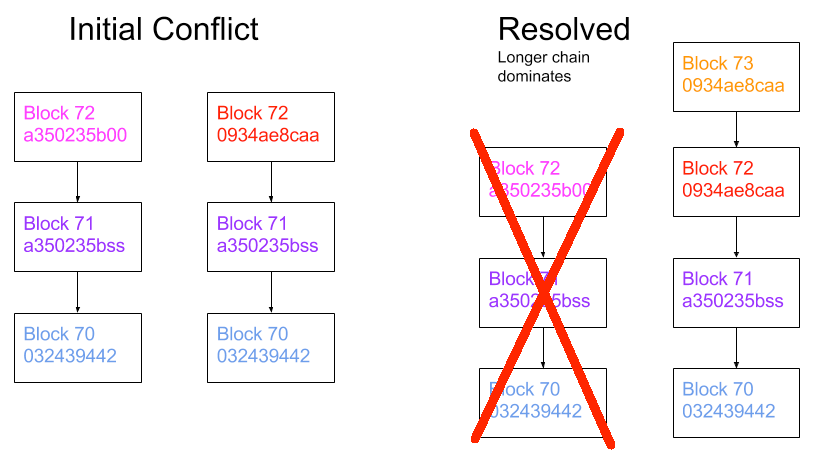

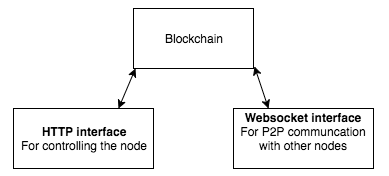

Blockchain: Bitcoin is powered by open-source code known as blockchain, which creates a shared public ledger. Each transaction is a “block” that is “chained” to the code, creating a permanent record of each transaction. Blockchain technology is at the heart of more than 6,000 cryptocurrencies that have followed in Bitcoin’s wake.

Private and public keys: A bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions, providing proof of authorization.

Bitcoin miners: Miners — or members of the peer-to-peer platform — then independently confirm the transaction using high-speed computers, typically within 10 to 20 minutes. Miners are paid in bitcoin for their efforts.

How does Bitcoin make money?

Bitcoin value follows the law of supply and demand — and because demand waxes and wanes, there’s a lot of volatility in the cryptocurrency’s price.

Besides mining bitcoin, which requires technical expertise and an investment in high-performance computers, most people purchase bitcoins as a form of currency speculation — betting that the U.S. dollar value of one bitcoin will be higher in the future than it is today. But that's difficult to predict.

Storing your bitcoins: Hot wallets vs. cold wallets

Bitcoins can be stored in two kinds of digital wallets:

Hot wallet: Digital currency is stored in the cloud on a trusted exchange or provider, and accessed through a computer browser, desktop or smartphone app.

Cold wallet: An encrypted portable device much like a thumb drive that allows you to download and carry your bitcoins.

Basically, a hot wallet is connected to the internet; a cold wallet is not. But you need a hot wallet to download bitcoins into a portable cold wallet.

Buying Bitcoin: The pros and cons

With a speculative asset class like bitcoin, it’s better to start with why you should be wary:

Bitcoin: The cons

Price volatility. The 2017 spike in Bitcoin’s price was driven by speculators rushing into the bitcoin market, as NerdWallet staff writers discussed at the time. The recent gains are good news if you bought Bitcoin in December 2018; those who bought in 2017 when Bitcoin’s price was racing toward $20,000 had to wait until December 2020 to recover their losses.

Hacking concerns. While backers say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets have been an attractive target for hackers. There have been a number of high-profile hacks, such as the news in May 2019 that more than $40 million in bitcoin was stolen from several high-net-worth accounts on cryptocurrency exchange Binance (the company covered the losses).

Limited (but growing) use. In May 2019, telecommunications giant AT&T joined companies such as Overstock.com, Microsoft and Dish Network in accepting bitcoin payments. But these companies are the exception, not the rule.

Not protected by SIPC. The Securities Investor Protection Corporation insures investors up to $500,000 if a brokerage fails or funds are stolen, but that insurance doesn’t cover cryptocurrency.

Bitcoin: The pros

Private, secure transactions anytime — with fewer potential fees. Once you own bitcoins, you can transfer them anytime, anywhere, reducing the time and potential expense of any transaction. Transactions don’t contain personal information like a name or credit card number, which eliminates the risk of consumer information being stolen for fraudulent purchases or identity theft. (Keep in mind, though, that to purchase bitcoins on an exchange, generally you'll first need to link your bank account.)

The potential for big growth. Some investors who buy and hold the currency are betting that once Bitcoin matures, greater trust and more widespread use will follow, and therefore Bitcoin’s value will grow.

The ability to avoid traditional banks or government intermediaries. After the financial crisis and the Great Recession, some investors are eager to embrace an alternative, decentralized currency — one that is essentially outside the control of regular banks, governing authorities or other third parties. (However, to buy Bitcoin on an exchange with U.S. dollars, you'll likely need to link your bank account.)

Where can I buy Bitcoin?

There are four ways to get bitcoins:

Cryptocurrency exchanges. There are a number of exchanges in the U.S. and abroad. Coinbase is the largest cryptocurrency exchange in the U.S., trading more than 30 cryptocurrencies.

Investment brokerages. Robinhood was the first mainstream investment broker to offer Bitcoin and other cryptocurrencies (Robinhood Crypto is available in most, but not all, U.S. states). Tradestation, eToro and Sofi Active Investing also offering cryptocurrency trading in most U.S. states.

Bitcoin ATMs. There are more than 7,000 bitcoin ATMs in the U.S. (search Coin ATM Radar to find one near you).

Peer-to-peer purchases. True to its original spirit, you can buy bitcoins directly from other bitcoin owners through peer-to-peer tools like Bisq, Bitquick and LocalBitcoins.com.

Bitcoin mining. You can earn bitcoins through mining, but the technical expertise required and computer cost puts this option out of reach for most.